-

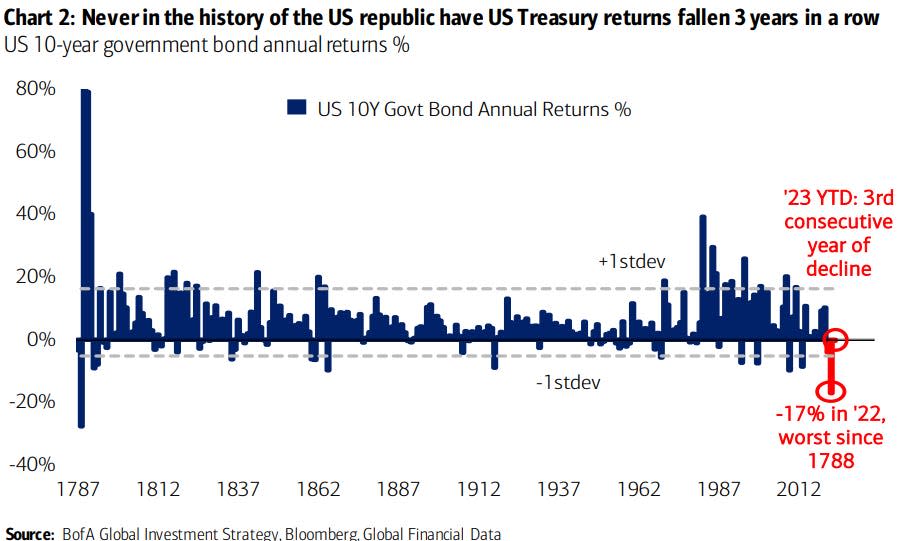

The 10-year US Treasury is on track for three consecutive years of losses.

-

A back-to-back recession would mark the longest period of losses since 1787, according to Bank of America.

-

This decline comes after US Treasury bonds suffered their worst annual loss since 1788.

Our plan for today is American bank It shows that US Treasury bonds are heading for the longest period of losses ever, dating back to 1787.

The 10-year US Treasury is on track to post its third consecutive annual loss. The 10-year notes fell 3.9% in 2021, and are down 17% in 2022, their worst annual loss since 1788. So far this year, they are down 0.3%.

“The 10-year treasury is on course for a third straight loss… never in the 250-year history of the American Republic. Reflects a staggering 40% jump in US nominal GDP (growth + inflation) since its lows in 2020.” Michael is an investment strategist at Bank of America. Hartnett said in a note Friday.

The pain in bonds has been driven by aggressive interest rate increases by the Federal Reserve. Since March 2022, the Fed has raised interest rates 11 times, taking the effective federal funds rate from around 0% to more than 5% today. As interest rates go up, bond prices go down, which is why bonds have performed so poorly.

Despite the long slump in fixed income, investors poured $1.7 billion into bonds this week, marking the 23rd consecutive week of inflows, according to Bank of America.

Read the original article at Interested in trade