-

August has historically been a difficult month for the markets.

-

This year was no exception as the stock rally stalled.

-

Here are some of the biggest winners and losers for this month.

August is often a difficult month for the markets as investors take a vacation and trading volume drops, and 2023 was no exception.

Stocks fell before recouping some of their losses, as Wall Street continues to try to see how close the Federal Reserve is to ending its long campaign of rate hikes.

However, there are still some sources of optimism amid the gloom U.S. dollar Breaking a two-month losing streak nvidiaThe company’s share price hit a record high after an excellent second-quarter earnings report.

Here are August’s biggest winners and losers.

Loser: stocks

The wonderful year of 2023 came to a halt on Wall Street last month, with Standard & Poor’s 500 And Dow Jones Industrial Average Both slide, despite the hefty technology Nasdaq Composite I managed another month of gains.

The indices’ losses were driven by the Fed after its chairman, Jerome Powell, took a hawkish tone in Jackson Hole, and Monthly inflation data The central bank indicated that it may take longer than expected for the central bank to return to its 2% target.

Things could have been worse but stocks enjoyed a strong final week of the month. Supported by economic data that showed a slowdown in the labor market. This reinforces the notion that there will be fewer rate hikes as the Fed is keen to avoid a spike in unemployment.

Bond yields also fell In the last week of the month, which helps to enhance the attractiveness of stocks compared to fixed-income assets.

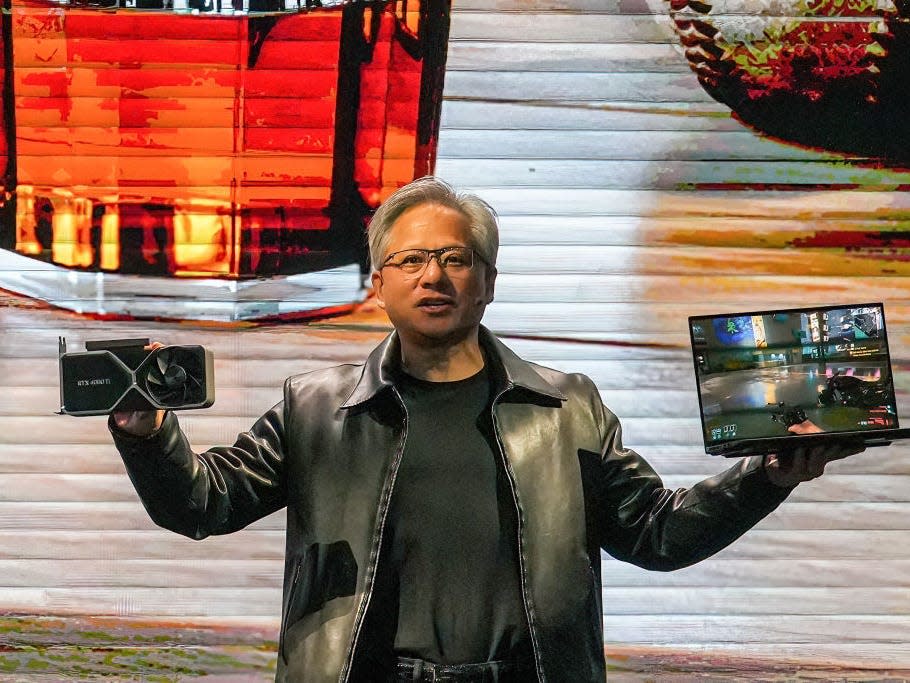

Winner: Nvidia

August wasn’t dismal for stocks, though, as the markets’ biggest success story of 2023 continued its stellar year.

Nvidia shares rose 11% over the month after its second-quarter earnings beat Wall Street expectations and issued stellar earnings guidance indicating that the rise of artificial intelligence has fueled demand for its chips.

The semiconductor giant, which produces about 95% of the graphics processing units (GPUs) capable of this Run programs such as ChatGPTwhich is now up an astonishing 240% this year, breaking into the Trillion Dollar Club and cementing itself as a member of the “Magnificent Seven” mega technology stocks..

Winner: US dollar

the dollar It remains one of the biggest losers in 2023, down more than 5% this year.

This is because the Fed has signaled that there is an end in sight to its tightening campaign, which reduces the currency’s attractiveness to foreign investors looking for higher returns.

However, the dollar managed to recoup some of its losses in August thanks to fresh signs of Fed tightening, with US dollar index – which tracks the value of the dollar against six rival currencies, including the euro and the Japanese yen – jumped 2% over the month.

Loser: China

It has been another bad month for the world’s second largest economy, which is grappling with deflation, weaker-than-expected growth, and economic crisis. The escalating real estate crisis which developed the eminent developer country parkIts existence is in danger.

The headlines have been so bad for China that suddenly Beijing I stopped reporting youth unemployment data – and even He asked prominent economists to stop being so negative in public places, The Financial Times reported.

The struggles Chinese stocks faced in August captured some of that carnage CSI 300 Down 5% Meanwhile, the renminbi fell to a record low against the dollar, as policymakers cut interest rates in a bid to boost the economy.

Read the original article at Business interested